Have you missed the silver rally or sold it too early?

If you feel that way, you’re not alone.

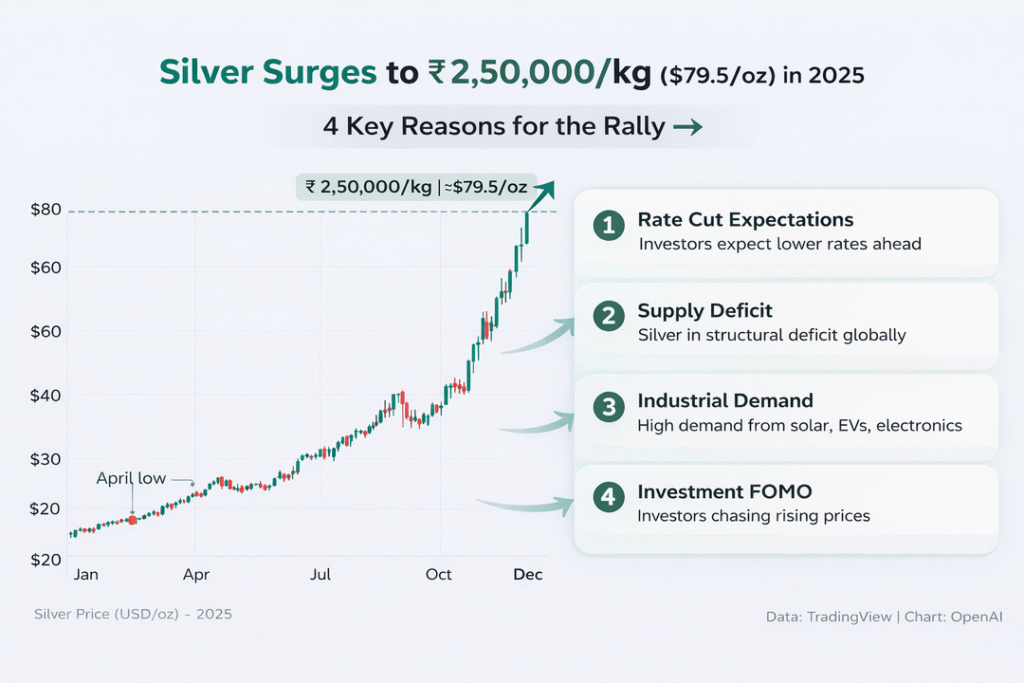

Silver has delivered one of the strongest commodity rallies in 2025. After touching levels around ₹94,000 per kg in April 2025, prices have surged to the ₹2,40,000–₹2,50,000 per kg zone, creating excitement, regret, and FOMO all at once.

Become a Stock Market PRO!

Join @Mobodaily Telegram Channel, and get high-quality swing trading ideas (averaging 10%+ returns), daily market news & crucial IPO reviews.

The key question most people are asking is:

👉 Is it the right time to buy silver now, or should you wait for a price correction?

Let’s look at the data — not opinions.

Why is silver rallying so sharply in 2025?

Silver’s move is not random. It is being driven by a combination of macro trends, real industrial demand, and supply deficits.

🔹 Record-breaking price action

- International silver recently moved to around $79.5 per ounce, marking fresh record highs.

- In Indian markets, prices surged to about ₹₹2.50 lakh per kilogram in late 2025.

- From April lows to current levels, the rally translates into roughly 150% gains in less than a year.

This is one of the strongest yearly moves in silver in decades.

🔹 Rate-cut expectations supporting precious metals

Silver is a non-yielding asset, so falling interest rates make it more attractive.

Markets are currently expecting:

- future Federal Reserve rate cuts

- easing policy as inflation cools

- slower economic growth ahead

Lower interest rates reduce the opportunity cost of holding silver instead of interest-bearing instruments. That’s one key reason precious metals are gaining momentum.

🔹 Structural supply deficit in the silver market

According to globally tracked silver market data:

- The silver market is running a multi-year structural deficit

- Mined silver supply has not kept pace with total demand

- This marks the fifth straight year of deficit conditions

Mined production remains close to ~813 million ounces, while combined industrial and investment demand exceeds this level. As inventories are drawn down, prices face upward pressure.

🔹 Industrial demand is a major growth engine

Unlike gold, silver is heavily industrial.

More than 50% of total silver demand now comes from sectors such as:

- Solar panels and renewable energy

- Electric vehicles

- Semiconductors and electronics

- Data centres and AI hardware

- Medical devices and sensors

Growth in solar PV and EV adoption has significantly lifted consumption, while supply growth has remained slow. This dual demand — investment + industry — is what makes the silver rally stronger.

🔹 ETF and investor participation are rising

Another important trend:

- Strong inflows into silver ETFs

- Rising allocation from both retail and institutional investors

This indicates that demand isn’t just from physical buying but also from financial investment channels.

🔹 Macro and geopolitical risks

Silver has also benefited from:

- persistent geopolitical uncertainty

- inflation worries

- bouts of currency weakness

This makes silver attractive as both:

- A hedge asset like gold, and

- An industrial metal tied to future technology growth

Is silver overvalued right now or is this the new normal?

Short answer: short-term overheated ⚠️, long-term supported ✅.

Short-term perspective

- massive one-year price surge

- strong momentum and sentiment

- higher-than-usual volatility

Silver historically shows larger corrections than gold, and pullbacks of 10–20% inside an uptrend are common.

Long-term perspective

The fundamental case still stands:

- structural supply deficit

- rising industrial demand

- recurring expectations of rate easing

- tight inventory environment

So while price may cool in the short run, the broader bullish trend is not broken.

Should you buy silver now or wait for a correction?

Here’s a practical framework.

🕒 If you are trading short term

Buying after a vertical rally carries risk.

- momentum is strong

- corrections in silver can be sharp

- volatility is high

👉 Short-term approach: wait for dip or consolidation.

🧭 If you are investing long term (3–10 years)

You don’t need the perfect entry.

The smart strategy is:

- avoid lump-sum buying

- stagger purchases

- add on declines

- stick to defined allocation

👉 Long-term approach: gradual accumulation over time.

😬 If your reason is pure FOMO

Pause before acting.

Buying just because others made money usually leads to:

- top buying

- emotional exiting

- repeated regret

👉 Emotional approach: do nothing until you think clearly.

How to invest in silver the right way (without unnecessary risk)

Keep it simple. Avoid complex products.

✅ Physical silver (coins and bars)

Best for:

- long-term holding

- gifting

- people who prefer tangible assets

Checklist:

- buy 999 purity

- prefer bars/coins over jewellery

- ensure hallmarking

- consider storage and security

- understand resale spreads

✅ Silver ETFs (easy and low cost)

Best for:

- Demat investors

- small ticket systematic investing

- those who don’t want storage issues

Advantages:

- low cost structure

- tracks market price

- easy liquidity

- suitable for SIP-style accumulation

🚫 Products better avoided by most investors

- leverage futures and options

- high-cost “digital silver”

- complex structured products

They carry:

- higher fees

- counterparty risk

- high emotional trading temptation

Final verdict: Should you buy or wait?

Silver’s rally is backed by data, not hype, but the speed of the move makes short-term corrections likely.

So:

- don’t chase aggressively

- don’t freeze completely either

Best approach

- short-term traders → wait for dips

- long-term investors → accumulate gradually

- FOMO buyers → slow down and plan first

You don’t need to win the last rally.

You just need to avoid the next bad decision.

Frequently Asked Questions

Is it the right time to buy silver in 2025?

It may not be ideal for aggressive lump-sum buying due to recent sharp gains. Long-term investors can stagger purchases, while traders may wait for corrections.

Will silver prices correct after the rally?

Silver is historically volatile. Corrections of 10–20% are common even during bull markets, especially after steep rallies.

Is silver better than gold right now?

Silver is more volatile and more linked to industrial demand. Gold is more stable and purely monetary. Choice depends on your risk tolerance.

What is the safest way to invest in silver?

For most investors, the simplest and safest routes are: physical coins or bars, and silver ETFs because they avoid leverage and high hidden charges.

Disclaimer: Parts of this article were created using AI assistance. Please treat this content as informational and not as personalized financial advice.

Kushal Utreja is a seasoned digital entrepreneur and the founder of the financial news platform, Stockdigest.in. He combines over six years of hands-on experience as a trader and investor with a deep expertise in digital content strategy and Search Engine Optimization (SEO). His trading specializations include swing and intraday approaches to stocks, futures, and options.

Previously, as the Editor-in-Chief and SEO Specialist for Helplama.com (2021-2023), Kushal was instrumental in growing the site’s Domain Authority to an impressive 68. He founded Stockdigest.in to merge his passion for the markets with his proven digital skills, creating a timely and relevant news source for fellow traders.

Discover more from Stockdigest

Subscribe to get the latest posts sent to your email.