Searching for the best SEBI-registered Telegram channels in 2025?

I’m Kushal Utreja, founder of Stockdigest.in. After 6+ years of active trading, I know the biggest challenge is filtering out the noise.

While many traders search for a “Top 10 SEBI registered Telegram channel,” I’ve expanded the list to 20 to give you a comprehensive and honest review.

Become a Stock Market PRO!

Join @Mobodaily Telegram Channel, and get high-quality swing trading ideas (averaging 10%+ returns), daily market news & crucial IPO reviews.

My goal is to provide the best SEBI registered Telegram channel list to help you find credible, accountable advice and avoid the scams.

A. List of Best SEBI-Registered Telegram Channels In India

Before we dive into the detailed reviews, here’s a quick overview of the top SEBI-registered channels. Use this table to find the channel that best matches your trading style and click the link to check them out directly.

| Channel Name | Focus Area | Channel Link |

|---|---|---|

| Mirae Asset Sharekhan | Swing & Intraday Calls | View Channel |

| Systematix Group | Institutional Research, All Segments | View Channel |

| Samco | All Trading & Investment Segments | View Channel |

| Angel One Research | Intraday Equity & Index Options | View Channel |

| Trading with CA Abhay | Nifty & BankNifty Options, Education | View Channel |

| Index trading with CA Nitin Murarka (SMC) | Index Options & Live Trading | View Channel |

| The Chartians | Price Action & Technical Analysis | View Channel |

| Rajesh Palviya | Technical Analysis, F&O | View Channel |

| Finance With Sunil | Intraday & Positional Trading | View Channel |

| Equitymaster | Long-Term Investment & Market Research | View Channel |

| PL Technical Research | Technical & Derivative Analysis | View Channel |

| Learning with PlutusAdvisors | Options Buying & Hedging Strategies | View Channel |

| Chase Alpha | Intraday & Swing Trading | View Channel |

| Ashika Calls | Intraday, BTST, & Swing Calls | View Channel |

| Stockbox Trading | Intraday & Swing Trading | View Channel |

| Financial Sarthis | F&O and Equity Calls | View Channel |

| Platinum Research | Equity & Commodity | View Channel |

| Money creates Money | Intraday & Swing Trading | View Channel |

| Equity99 | F&O and Equity Calls | Link Withheld |

| Eqwires Research | Equity, Commodity, & Forex | Link Withheld |

B. How To Find Best Telegram Channels by SEBI-Registered RAs

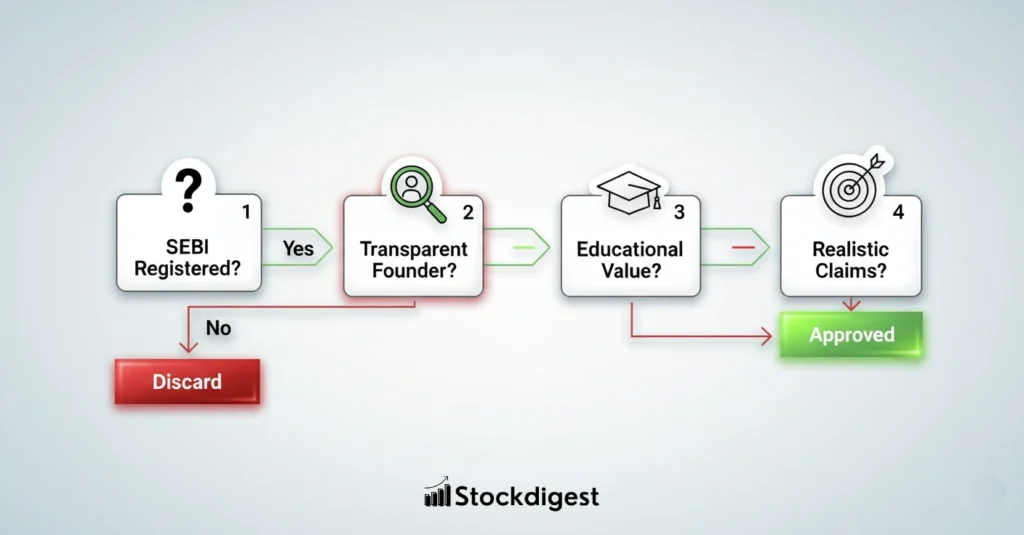

Before a channel ever makes it to my recommendation list, it has to pass a rigorous vetting process. My painful experience with the “SHUBHAM” stock, where I was trapped in a pump-and-dump scheme, taught me to be ruthless in my evaluation. This isn’t just about finding profitable calls; it’s about protecting your capital from manipulators.

Here is the exact 5-point checklist I use to separate the genuine experts from the dangerous amateurs:

1. SEBI Registration: The Non-Negotiable Filter

This is my first and most important check. If a channel’s admin or parent company is not registered with the Securities and Exchange Board of India (SEBI), I don’t even consider it for my “best of” list. A SEBI registration means the analyst is qualified, accountable, and operates under a legal framework designed to protect investors. An unregistered “guru” has zero accountability; they can disappear tomorrow, and you’ll have no recourse.

2. Founder Transparency: Who is Behind the Curtain?

I look for channels run by real people with public profiles and a verifiable track record. Are they a known analyst at a brokerage? Do they appear on financial news channels? Anonymous admins are a massive red flag. Transparency builds trust. If someone isn’t willing to attach their name and reputation to their advice, I’m not willing to risk my money on it.

3. Realistic Claims vs. “Jackpot” Promises

Professional trading is a game of probability and risk management, not a casino. I immediately dismiss any channel that promises “100% accuracy,” “sure-shot calls,” or “guaranteed jackpots.” This is the classic language of scammers appealing to greed. A professional channel talks about risk-reward ratios, stop-loss discipline, and market analysis. They focus on the process, not just the fantasy of overnight riches.

4. Educational Value: Do They Teach You to Fish?

The best channels don’t just give you signals; they empower you to become a better trader. I prioritize channels that share the logic, charts, and analysis behind their trade ideas. Do they explain why a stock is a good buy based on a technical breakout or fundamental strength? A channel that only provides blind “buy/sell” calls creates dependency. A channel that educates creates independent, successful traders.

5. Community and Professionalism: What’s the Vibe?

Finally, I observe the tone and quality of the posts within the channel. Is it filled with hype, memes, and “to the moon” comments, or is the conversation sober, analytical, and respectful? Professional channels foster a community of serious traders who discuss strategies and market conditions, not just celebrate screenshots of profits. The vibe of the community is often a direct reflection of the admin’s professionalism.

C. Top 5 SEBI Registered Telegram Channels (Multi-niche)

These channels are for traders who want all-in-one solutions for different stock market tips and information–news, learning, equity, intraday, F&O, and more.

1. Samco

My Take: I consider Samco’s channel a goldmine because of its sheer versatility and trustworthiness. Backed by the Samco Securities Group, it’s a one-stop shop that caters to virtually every type of market participant. Whether you’re a positional investor, an F&O trader, or an intraday player, this channel delivers.

- SEBI-registered: Yes

- Founder: Samco Securities Group

- Pricing: Free

- Features: Provides a wide range of calls suitable for positional, F&O, intraday, and swing traders.

2. Finance With Sunil

My Take: This is one of the best SEBI-registered Telegram channels I have come across, especially for those serious about their education.

Sunil Gurjar provides a fantastic mix of actionable calls—including swing, positional, and momentum trades—along with daily educational content. The goal here is clearly to help you become a successful trader on your own.

- SEBI-registered: Yes

- Founder: Sunil Gurjar

- Pricing: Freemium, with paid courses and books available.

- Features: Provides a wide variety of calls (swing, positional, momentum). Strong focus on daily education to make traders self-sufficient.

3. Money creates Money

My Take: The credibility here is boosted by its founder, Vibhor Varshney, a NISM Certified panelist on ET Now Swadesh and an eight-time winner of “Khiladi No. 1” on CNBC Awaaz.

This public presence provides trust. The channel is a great all-in-one resource, offering equity cash, swing, and options calls, all posted with proper stop-loss and target levels.

- SEBI-registered: Yes

- Founder: Vibhor Varshney

- Pricing: Freemium, with premium quotes available via WhatsApp.

- Features: Run by a NISM-certified founder with multiple media appearances and awards. Provides equity cash, swing, and options calls in one place.

4. PL Technical Research

My Take: This channel, run by the well-respected brokerage Prabhudas Lilladher, is a no-frills, reliable source of technically sound trade ideas. It’s all about direct, actionable calls.

What I appreciate is the variety—momentum picks, positional calls, or technical trade setups. This makes it a great all-around channel for a technical trader who wants a steady stream of vetted ideas.

- SEBI-registered: Yes

- Founder: Prabhudas Lilladher

- Pricing: Free

- Features: A direct feed of technically vetted trade ideas from a brokerage’s research desk. It offers a variety of calls, including momentum, technical, and positional picks.

5. Ashika Calls

My Take: If you find most trading channels too noisy, this one is for you. In my view, Ashika Calls is the best minimalist option available. It’s a call-specific channel and nothing else—no news, no commentary, no unnecessary chatter.

You get direct, actionable trade calls for intraday, swing, and options from a registered entity.

- SEBI-registered: Yes

- Founder: Ashika Group

- Pricing: Free

- Features: A minimalist, call-specific channel. Provides intraday, swing, and options calls with clear, direct communication.

D. Best SEBI-Registered Channels For Intraday Trading

1. Angel One Research

My Take: This is a top-tier channel, especially for those who focus on intraday equity and index options. Coming from one of India’s biggest brokerage houses, the expertise and research behind each call are palpable.

For anyone specifically looking for a sebi registered telegram channel for intraday trading, Angel One is a must-follow due to its active management of open positions and clear exit guidance.

- SEBI-registered: Yes

- Founder: Angel One Limited

- Pricing: Free

- Features: Managed by a trusted brokerage house team, specializing in intraday equity and index options calls. Provides active updates for exiting positions or booking profits.

2. Systematix Group

My Take: If you want to start thinking less like a retail trader and more like an institutional one, this is the channel to follow. Systematix Group provides a macro-level view that is incredibly valuable for understanding the “why” behind market movements.

They deliver data-driven analysis on the broader economy and sectors, which gives crucial context to their trade calls.

- SEBI-registered: Yes

- Founder: Systematix Group

- Pricing: Free

- Features: Institutional-level research, daily market updates, stocks to watch, and sober data-driven analysis. They provide intraday, futures, and swing calls daily, with occasional options trading ideas.

3. Financial Sarthis

My Take: If you’re looking for a channel with a disciplined and structured approach to intraday trading, your search could end here. Before the market opens, they share key levels and a stocks-to-watch list. Then, they focus on just one or two high-quality intraday trades rather than overwhelming you with calls. This focus on quality over quantity makes it a solid choice.

- SEBI-registered: Yes

- Founder: Lalit Mundhra

- Pricing: Free

- Features: Shares pre-market levels and a daily watchlist. Focuses on 1-2 high-quality equity and derivative trades daily.

4. Mirae Asset Sharekhan

My Take: In my opinion, this channel is the best SEBI-registered Telegram channel for swing trading. Coming directly from a top-tier brokerage like Mirae Asset Sharekhan, every piece of information is backed by a professional research team.

There’s no hype or speculation, just sober, well-analyzed trade ideas. Their presentation is exceptionally clear, making it easy to understand the logic, timeframe, and risk for each call.

- SEBI-registered: Yes

- Founder: Shripal Morakhia / Mirae Asset

- Pricing: Free

- Features: High-quality, professional-grade market intelligence; clear presentation of swing and intraday trading ideas with defined time frames.

E. Best SEBI-Registered Telegram Channels For Options Trading

WARNING: Trading in equity Futures and Options is extremely risky.

- 90% of individual traders lose money.

- The average loss is around ₹50,000, but transaction costs make it worse.

- On top of trading losses, you will pay an additional 28% in fees.

- Even if you win, fees can take up to half of your profit.

Source: SEBI study “Analysis of Profit and Loss of Individual Traders dealing in equity Futures and Options (F&O) Segment,” dated January 25, 2023.

1. Trading with CA Abhay

My Take: This channel is a benchmark for professionalism. CA Abhay Sharma brings a quantitative, rule-based approach that removes the hype from trading.

His live trading sessions on YouTube are an invaluable learning resource for understanding proper risk management. It’s the best sebi registered telegram channel for options trading if your goal is to learn a sustainable system.

- SEBI-registered: Yes

- Founder: CA Abhay Sharma

- Pricing: Freemium, with premium plans starting from ₹3000

- Features: Focuses on Nifty & BankNifty options, live trading on YouTube, promotes a quantitative and rule-based approach, excellent for learning risk and position management.

2. Stockbox Trading

My Take: This channel is excellent for those who want to learn the ‘why’ behind every trade. The focus here is on pure price action, with the clear goal of helping traders become self-reliant.

Instead of just spoon-feeding signals, they provide 1-2 swing and options trading tips daily with analysis that helps you understand the underlying technicals.

- SEBI-registered: Yes

- Founder: RS Chauhan

- Pricing: Free

- Features: Focuses on helping traders become self-reliant through price action education. Provides 1-2 daily tips on stock options and swing trading.

3. Rajesh Palviya

My Take: Following this channel is like having a top-tier research head’s analysis delivered directly to your phone. Rajesh Palviya is known for his sharp and actionable insights, particularly on Nifty and BankNifty.

This is an ideal channel for derivative traders who value expert commentary on the indices. It’s about quality over quantity here.

- SEBI-registered: Yes

- Founder: Rajesh Palviya

- Pricing: Free

- Features: Provides analysis from a top-tier research head. The channel is known for offering sharp, actionable insights, with a focus on Nifty and BankNifty.

4. Platinum Research

My Take: This reliable channel focuses on high-quality options signals without spam. Priti Tiwari starts your day with morning market commentary in her voice. After that, you get 1-2 index or stock options calls free.

For high conviction calls, they offer a unique “pay-as-you-go” model where you can pay for individual high-conviction calls instead of a monthly subscription. This is excellent for traders who don’t want to commit to a recurring fee but are willing to pay for well-researched, individual trade ideas.

- SEBI-registered: Yes

- Founder: Priti Tiwari

- Pricing: Freemium, the premium calls priced at ₹300-₹600 per call.

- Features: A no-clutter, no-spam channel focused on high-quality index and stock options tips. Offers a unique pay-per-call model for premium trades.

5. Index trading with CA Nitin Murarka (SMC)

My Take: This channel is as reliable as it gets, primarily because it’s run by the Head of Derivative Research at SMC Global Securities. Nitin Murarka is a familiar face on business news channels like Zee Business, which adds another layer of credibility.

The free channel offers great insights, but the premium service is for serious, well-capitalized traders, transparently requiring a minimum capital of ₹1 lakh to trade 2 lots.

- SEBI-registered: Yes

- Founder: Nitin Murarka

- Pricing: Freemium, with paid services starting from ₹3999

- Features: The premium channel focuses on Nifty Index options with a mix of hedged and naked positions, executing 1-2 trades per day.

6. The Chartians

My Take: If I had to describe this channel in one word, it would be “insightful.” For a technical or intraday trader, this channel is an absolute powerhouse.

The best feature is the high-quality Nifty levels they share throughout the day. These are actionable levels you can use to build your own trading strategy, with constant updates from the opening bell to the close.

- SEBI-registered: Yes

- Founder: Rajnikant Bhalani

- Pricing: Freemium, with premium services starting around ₹4k

- Features: Provides insightful market information and knowledge. Known for excellent Nifty levels that can be used for trading. Offers constant updates on market activity throughout the trading day.

F. Other Leading SEBI-Registered Telegram Channels

1. Equitymaster

My Take: Let me be clear: this is not a channel for traders. Equitymaster is the gold standard for legitimate, long-term value investing research.

Think of it as the “Warren Buffett” of Telegram. If you are a serious investor looking to build a portfolio of quality stocks over several years, their credibility is a benchmark for the entire industry.

- SEBI-registered: Yes

- Founder: Ajit Dayal

- Pricing: Freemium, with paid services and tools starting from ₹10k per month

- Features: Provides stock market research and news. A benchmark for credible, long-term value investing research; not suitable for intraday traders.

2. Learning with PlutusAdvisors

My Take: I want to be very clear about this one: as the name suggests, this is a channel for learning. You will not find direct buy/sell signals here. Instead, founder Prakash shares a wealth of knowledge on global markets, domestic stocks, and the micro and macro factors that influence them.

If your goal is to become a more knowledgeable and independent investor, this channel is an excellent educational resource.

- SEBI-registered: Yes

- Founder: Prakash

- Pricing: Free

- Features: Focuses on learning the fundamentals and essentials of the stock market. Keeps you updated on trends and the micro/macro factors affecting the market. It is an educational channel and does not provide direct calls or signals.

3. Chase Alpha

My Take: If you’re a regular viewer of Zee Business, you’ll likely recognize the founder, Vishvesh Chauhan. This Telegram channel primarily serves as a hub for his market updates and posts. For specific trading and investment calls, you are directed to download their app, “Richie”. Think of this channel as a companion to his media appearances.

- SEBI-registered: Yes

- Founder: Vishvesh Chauhan

- Pricing: Free

- Features: Provides market research and updates from founder Vishvesh Chauhan. Trading and investment calls are provided through their separate app, Richie

G. SEBI-Registered Channels With a Red Flag (AVOID)

WARNING: The following channels are SEBI-registered, but my research uncovered a history of serious regulatory action. This is a dealbreaker for me. I strongly advise traders to avoid them.

19. Equity99

Channel Link: Withheld

My Take: While this firm is SEBI-registered, its registration faced a temporary suspension in the past—a severe regulatory action. For me, this is a major red flag. A history of suspension raises serious questions about compliance and reliability. I cannot in good conscience recommend a service with such a history.

- SEBI-registered: Yes

- Founder: N/A

- Pricing: N/A

- Features: This firm has a history of temporary suspension from SEBI, a significant red flag.

20. Eqwires Research

Channel Link: Withheld

My Take: This is another example of why due diligence is so important. Although this entity is registered with SEBI, it was previously penalized by the regulator for providing unauthorized advisory services. This is a documented case of operating outside the rules. Given this documented penalty, I recommend traders stay far away.

- SEBI-registered: Yes

- Founder: N/A

- Pricing: N/A

- Features: Has been penalized by SEBI for unauthorized advisory services in the past.

H. The Dark Side: How I Got Trapped by a “Jackpot” Channel

I’ve shared my SEBI registered Telegram channel list, but it’s equally important to show you why I am so strict in my vetting. My caution is born from a brutal, expensive lesson.

It started with a random message promising “sure-shot tips.” I joined an unregulated channel, and the admin recommended a small-cap stock called SHUBHAM. I bought around ₹30,000 worth. In just a few days, the stock hit the upper circuit, and my investment shot up by nearly 50%.

The admin was insistent: “Hold! This will double next week!” The classic appeal to greed. I held on tight.

Then, Monday came. The stock hit the lower circuit. For those who don’t know, that means there are only sellers and zero buyers. You are completely trapped. I spent the next two weeks desperately trying to sell, watching my investment’s value evaporate. After two weeks, my shares finally sold, locking in a massive loss.

The lesson was clear: we weren’t investors; we were the exit liquidity. This is a classic pump-and-dump scheme. It’s why channels with a history of regulatory issues are so dangerous.

I. 5 Golden Rules for Trading Success (And Survival)

That painful experience taught me that your trading rules are your ultimate defense. Following a good channel is helpful, but without your own disciplined framework, you’re still vulnerable.

- Always Use a Stop-Loss: This is non-negotiable. Before you enter any trade, you must know your exit point. A stop-loss order is the single most important tool for capital preservation.

- Demand a Favorable Risk-Reward Ratio: I never enter a trade unless the potential profit is at least twice my potential loss (a 1:2 ratio). This means that even if only half my trades are successful, I can still be profitable.

- Do Not Overtade: The market will always be there tomorrow. I limit myself to a maximum of 5 trades per day. Overtrading often leads to revenge trading and emotional decisions.

- Practice Strict Daily Risk Management: I have a hard “kill switch.” If I lose 3% of my trading capital in a single day, I shut down my terminal and walk away. This prevents one bad day from wiping out a week’s worth of gains.

- Master Position Sizing: When you are starting out, always start small. If you’re new to options trading, begin with just one lot. Your goal is to stay in the game long enough to succeed.

Ultimately, true success comes from continuous learning. The best traders never stop studying. If you’re serious, you must learn how the stock market works, master how to read candlestick charts, and read some of the best stock market books to build a strong foundation.

J. Frequently Asked Questions (FAQ)

Which is the no. 1 SEBI registered Telegram channel?

There is no official “No. 1” ranking. However, based on reliability and reputation, the channels run by top-tier brokerages like Mirae Asset Sharekhan, Systematix Group, Samco, and Angel One Research can be considered the safest and most trustworthy.

Which is the best SEBI registered tips provider?

The “best” provider depends entirely on your personal trading style. Many traders search for the best SEBI registered intraday tips provider Telegram channel, and for them, a channel like Angel One Research is a top choice due to its focus and active management. For learning options, Trading with CA Abhay is excellent. For long-term investing, Equitymaster is the benchmark.

Are free SEBI-registered Telegram channels really free?

Yes, the channels on this list are free to join. However, many operate on a “freemium” model. They provide valuable free content and some calls to build trust. So, is any sebi registered free telegram channel truly free for all its services? Usually not. They often have premium, paid services where they provide their high-conviction calls.

Can I get rich quickly by following Telegram channels?

No. That is the wrong mindset for trading. Professional trading is not a “get rich quick” scheme. These channels are tools, not magic wands. Success in trading comes from disciplined risk management, consistent learning, and patience. Any channel promising quick, guaranteed riches is likely a scam.

How much money do I need to start Stock Trading?

There’s no fixed amount, but it’s crucial to only trade with money you can afford to lose. Some channels have stated minimum capital requirements (e.g., ₹1 lakh). For most, you can start with a smaller amount, like ₹25,000 to ₹50,000, to practice position sizing. The key is to start small, focus on the process, and protect your capital.

Final Thoughts: Your Capital, Your Responsibility

The world of Telegram trading channels is a minefield of big promises and hidden risks. My goal with this guide was to give you a clean, trusted list to serve as a safe starting point.

Remember, no channel can replace your own due diligence and risk management. Your capital is your responsibility. Use these channels for high-quality ideas and analysis, but always filter them through your own trading rules. To get started, you’ll need a solid trading app and a commitment to being a lifelong learner.

Trade smart, stay informed, and protect your capital at all costs.

Talk to a SEBI Registered Pro for Free!

Disclaimer: This post is for educational purposes only and should not be considered financial advice. I am not a SEBI-registered analyst. The stock market is subject to market risks. Please consult with your financial advisor before making any investment decisions.

Discover more from Stockdigest

Subscribe to get the latest posts sent to your email.